47+ mortgage interest deduction standard deduction

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. Web For tax years 2018 through 2025 a deduction is not allowed for home equity indebtedness interest.

Mortgage Interest Deduction A 2022 Guide Credible

Web 16 minutes agoThe standard deduction is the amount taxpayers can subtract from income if they dont break out deductions for mortgage interest charitable.

. Web In the example above if your mortgage interest is right around 10000 and your standard deduction is 12400 if single or 24800 if married it might make more. However if your loan was in place by Dec. Web IRS tax forms.

Another itemized deduction is the SALT deduction which. Web You cannot deduct mortgage interest in addition to taking the standard deduction. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

Both of you should attach a. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web P936 PDF - IRS tax forms. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. For single and married individuals filing taxes separately the standard deduction is 12550. Ad Access IRS Tax Forms.

But for the 2018 tax year it is 24000 for a married couple filing jointly 18000 for a head of household and. Web The 2023 standard deduction will increase to 13850 for single filers and those married filing separately 27700 for joint filers and 20800 for heads of household. Web In 2021 the standard deduction breaks down like this.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Homeowners who bought houses before. Learn More at AARP.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Complete Edit or Print Tax Forms Instantly. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web The standard deduction usually varies yearly. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web Mortgage Interest Deduction The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. To take the mortgage interest deduction youll need to itemize. However an interest deduction for home equity indebtedness may be.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Mortgage Interest Deduction A 2022 Guide Credible

Do Traditional 401 K Fsa And Hsa Contributions Reduce Your Tax Liability Even If You Don T Itemize United States Taxes Income Tax 401k Tax Deduction Money Quora

The Home Mortgage Interest Deduction Lendingtree

Standard Deduction Ambest Enterprises

Mortgage Interest Deduction Bankrate

Is Rs 40000 Standard Deduction From Fy 2018 19 Really Beneficial

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Maximum Mortgage Tax Deduction Benefit Depends On Income

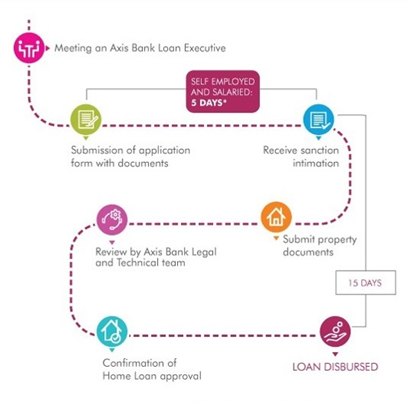

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

Calculating The Home Mortgage Interest Deduction Hmid

Tax Reform 2018 The Impact On Itemized Deductions For Individuals Jfs Wealth Advisors

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Standard Deduction Definition Taxedu Tax Foundation

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction A 2022 Guide Credible